Spelling of marubozu Check correct Spelling for marubozu

Contents

The real body would have been a long red candle as opposed to a small candle if the bears had been successful. Consequently, this might be viewed as a failed attempt by the bearish to drive the markets down. A long, muscular body without any wicks on each side defines the pattern. This is a common Marubozu pattern that, depending on the direction, maybe bullish or bearish. Marubozu open and close are distinguished if there are wicks to either side, and both of these candles are available in bullish and bearish configurations.

- These candlestick patterns strongly indicate a reversal or continuation of a trend, depending on their appearance on the trading chart.

- Volatility in the stock market is one of the most common factors that affect the prices of the stocks, and you will not be the only one undertaking that risk while investing in stocks.

- On the other hand, a bearish Marubozo found in a downtrend can signal further selling pressure, especially if found at the top of an uptrend.

- Candlestick charting has been popular since the days of Japanese rice merchants and rice traders.

This can also happen if there is a bad news related to the company or if a company announce financial results that are below expectations. The spinning top, however, provides insightful data regarding the state of the market at the moment. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND.

Trading with Marubozu candlestick patterns

In the chart, we can see a perfectly formed bullish Marubozu, the first one. In this hourly chart, this bullish pattern formed in the last hour. Some traders like to keep the stop loss just below the low of the Maroubozu candle. Others, more risk-averse traders may like to keep the stop loss just below the last swing low.

Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. Only 1st-time attempt at the quiz will be considered to qualify on the leaderboard.

Then the trader can think of using Marubozu in the trade. The two types of Marubozu candles have shaved heads and shaved bottoms, indicating the absence of shadows or wicks. The above image shows an example of a full bearish marubozu in the Adani Ent 15-minute chart.

Where to Invest?

You can set a stop loss at any price lower than the current to protect yourself against any fall in prices. Analysts use the Marubozu candlestick pattern to gain valuable insights into the future direction of a particular stock’s price. After analysing the Marubozu candlestick pattern, the investors use the data to hold new positions or adjust their present positions accordingly. But, before you read on to understand about the Marubozu candlestick pattern, let’s understand candlestick patterns.

For a highly volatile stock, a bigger stop loss like the last swing low is advised. At times we have a bearish candle that has a very small shadow at the end of a candle. Here the bears are very strong and did not allow the bull to dictate terms. After confirming what are they a trader now tries to interpret their significance. If a trader can affirm the trend nad then understand the positioning of the Marubozu candles, most of the trader’s job is done.

I consider moves of 6% or more to be wonderful, so this falls short. The best performance rank is 26 and that occurs after a downward breakout in a bull market. I think that with many single candle lines, expecting a huge post breakout performance just isn’t in the cards. Marubozu is one of the most powerful and clear candlestick. It can save your from entering a false trade and is a good filter for any trading strategy.

I shall again stress on the fact that a bullish or a bearish trade based only on the Marubozu candle should be avoided and should be confirmed with other technical indicators also. Here are different forms of Marubozu candles that can be seen in candlestick charts. Gaining days, or up days, strongly indicate that there is a greater demand for the stock than there is a supply. Or at least a greater demand for the stock than there is a willingness to sell it.

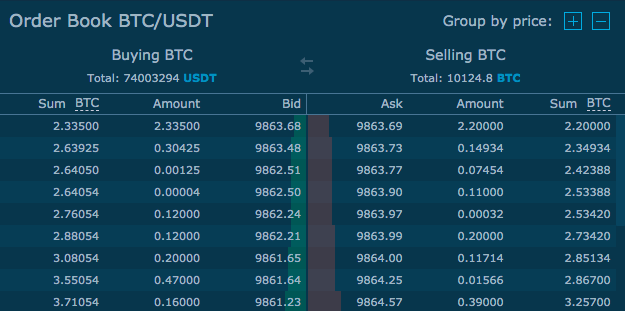

Here in the diagram above, the stop-loss price is shown just below the last swing low price. Ideally, a bullish Marubozu candle can signal a continuation of the bullish trend or reversal of the existing downtrend. After opening, the stock moved only in one way, upwards. So, all bid and ask prices were higher than the opening price, at which points the stock exchanged hands. So, we have a stock in our hand which was sold at consecutive higher prices all through the day and all buyers agreed to buy at higher prices. The diagram above shows a bullish Marubozu candlestick.

Volatility Indicators You Must Know to Trade Effectively

During a bullish trend, a Marubozu candlestick may have short wicks or shadows at either end. In a bullish pattern, we call these opening Maubozu and closing Marubozu. The Marubozu candlesticks are easily identified by their appearance. The bearish Marubozu is usually denoted by a red or black candle, whereas the bullish Marubozu can be of white, green or blue color. Later, we see large green or blue candlestick patterns depending on the viewer’s choice. The stocks mentioned in this article are not recommendations.

One can easily identify a Marubozu from their structure and type their colors. The above image shows three variations of bullish Marubozu patterns. If you are subscribing to an IPO, there is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account.

When Should One Invest?

In the shorter time frame chart, there may occur many signals which have no worth. It must be noted the stronger the selling interest of the traders, the larger the body of bearish https://1investing.in/. A large bearish Marobozu indicates that a bearish trend is going to set in if it is not already there. When the last trade of the day is the highest price of the day, the candle has no wick. Also, the opening price is greater than the closing price. Therefore the candle would be green and the wick and shadow wouldn’t be there.

On the other hand, a bullish Marubozu candlestick pattern always has the open price equal to the day’s low price and the close price identical to the day’s high price. The white marubozu candlestick is a tall white candle with no shadows. It suggests a continuation of the existing price trend but only 56% of the time. Thus, be prepared for the price to reverse direction before the breakout or soon thereafter. The frequency rank is high enough, 27, where 1 is the most popular, that you should have no trouble finding this candle in a historical price series.

When the red or black Marubozu candlestick is formed at an uptrend, it indicates a trend reversal and the rising presence of the buyers in the market. Traders can trade in this situation strategically using stop loss to minimize their losses. The Marubozu candlestick pattern is one of the most easily identified patterns that you can see in all chart time frames.

Both bearish and bullish marubozu candles indicate that the security’s price did not trade beyond the range of the opening and closing price. A Marubozu is a single candlestick pattern that indicates that the underlying stock or index traded in just one direction—on the upside—throughout the trading session on any given day. A Marubozu candle usually is just one long body candle with no upper or lower shadows.

These are only two large candles with no shadow or wick. These candles can only be differentiated by their colors. There’s no other distinguishable part in their structure. In Japanese, Marubozu means a close-cropped head or a clean-shaven head. As these candlesticks are easily recognizable, traders did not closely look into the depth of these candlesticks until lately. A close look into this pattern reveals some excellent hidden signals.

This implies that the opening price is equal to the market low and the closing price is equal to the market high. Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. During a bullish difference between underemployment and disguised unemployment candlestick pattern, the low price equals the open price, and the high price equals the close price.